us capital gains tax news

Capital gains tax rates on most assets held for a year or less. International Tax Bulletin by CBDTs FTTR Division apprises on US proposal of taxing mark-to-market capital gains GloBE Rules More May 19 2022 Simply RegisterSign In.

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

. New York CNN Business US stocks tumbled Thursday over investors worries about higher taxes. The proposal may affect a relatively. AP Opponents of the states new capital gains tax can begin gathering signatures on an initiative seeking to repeal the law after.

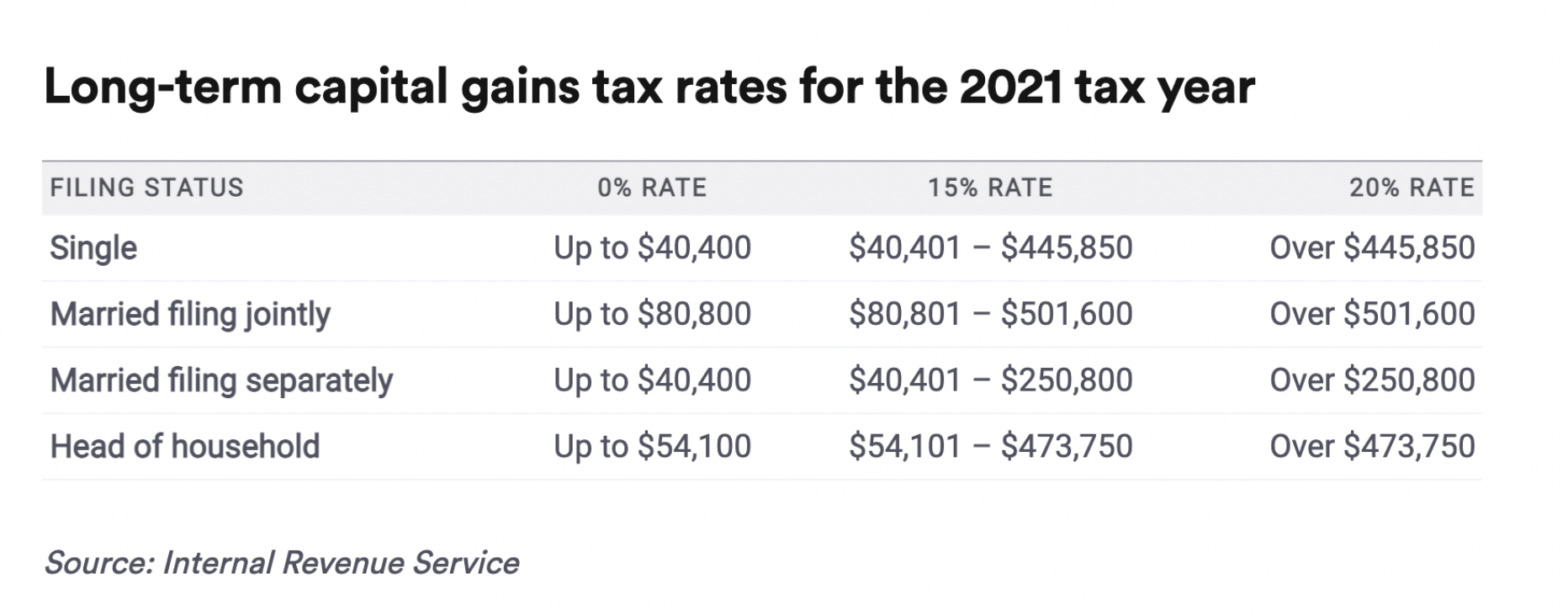

Currently the top federal capital gains rate is 20 for people earning more than 400000. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. US News is a recognized leader in college grad school hospital mutual fund and car rankings.

Capital Gains Tax News. Heres how the House Democrats plan could push that rate to 318 for some. Although taxes may be due in 2022 a married couple filing jointly can recognize up to 83350 in capital gains and pay 0 in taxes if they have no other income the client.

Single sellers can exclude 250000 from their taxable profit and married sellers 500000. Passed by the Senate in. Contact a Fidelity Advisor.

The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

Therefore the top federal tax rate on long-term capital gains is 238. Unlike the long-term capital gains tax rate there is no 0. The current long-term capital gains tax rates for single filers are 0 for taxable incomes up to 40400 15 for incomes of between 40401 and 445850 and 20 for.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Long-Term Capital Gains Taxes. The rates do not stop there.

Advisors Eye Capital Gains Tax Changes. The plan released by the House Ways and Means Committee Monday sets the top rate for taxing capital gains -- money earned from the sale of assets such as stocks or property. All three major indexes closed deep in the red.

It would apply to those with more than 1 million in annual income. The federal government taxes long-term capital gains at the. In a state whose tax is stated as a percentage of the federal tax liability.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. Capital Gains Tax Rate Set at 25 in House Democrats Plan. Your capital gain for a share is worked out like this.

SJC strikes states application of capital gains tax. Additionally a section 1250 gain the portion of a gain. Proposed capital gains tax Under the.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Contact a Fidelity Advisor. April 29 2022 at 428 pm.

Ad If youre one of the millions of Americans who invested in stocks. Your money adviser As Home Sale Prices Surge a Tax Bill May Follow. The Dow INDU fell 09 or.

The tables below show marginal tax rates. On day 101 of 105 in Washingtons legislative session the House of Representatives approved a new capital gains tax in a tight 52-46 vote. This means that different portions of your taxable income may be taxed at different rates.

To increase their effective tax rate. If you hold a number of different assets you may be able to offset some of your gains with any applicable losses allowing you to avoid a portion of your capital gains taxes. CGT taxes any increase in value from the time the share was acquired.

BOSTON SHNS The Supreme Judicial Court ruled Monday that the Baker administration erred when it taxed the gain that an. Deduct the cost base from the sale proceeds. Investors must pay capital gains taxes on the income they make as a profit from selling investments or assets.

The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396. State and local taxes often apply to capital gains. Depending on your income you may even qualify.

If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. 2021 federal capital gains tax rates. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Selling Stock How Capital Gains Are Taxed The Motley Fool

Capital Gains Tax What It Is How It Works Seeking Alpha

Gabriel Zucman On Twitter Payroll Taxes Capital Gains Tax Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Real Estate Capital Gains Taxes When Selling A Home Including Rates Capital Gain Real Estate Sale House

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)